Why I think it’s time to start getting your money out of the financial system

I don’t write this to worry or alarm.

I intend, soberly, to lay out how I presently see things.

Please tell me where I’m wrong.

1) Countries are changing their view of the U.S. dollar

In the past few weeks, China has played a key role brokering diplomatic relations between Iran and Saudi Arabia.

Highlights from a recent WSJ article:

‘Iran and Saudi Arabia agreed to re-establish relations after four days of secret talks in Beijing.

The restoration of diplomatic relations between Tehran and Riyadh, announced Friday in Beijing after years of enmity between the two capitals, reflects the new reality: with Washington increasingly preoccupied in Ukraine and Asia, the region is trying to move past its old divisions, resolving conflicts and easing tensions.

China has emerged as the world’s largest oil importer, which gives it a growing stake – and clout – in seeking stability in the conflict-ridden Middle East.

After years of acting as an oil consumer and otherwise mostly staying out of the region’s disputes, Beijing is intent on showing it offers something different than the U.S. – the ability to talk to all sides without lecturing them on human rights, an attractive prospect for the region’s many authoritarian regimes.

Unlike the U.S., which doesn’t have formal diplomatic relations with Iran, China has close diplomatic and economic ties with both Tehran and Riyadh. It is Iran’s biggest trade partner and a leading buyer of oil from Saudi Arabia, giving it leverage with both sides.’

This is not good for Israel, which had been benefiting from an isolated Iran.

But I consider the ramifications of this more financial than diplomatic/security-based.

Here are two mainstream clips that explain it well...

CNN:

Fox:

I implore you actually to watch both of these clips. They are important!

How often do Fox and CNN agree on things these days?

On top of this, you have luminaries of the U.S. establishment petitioning the Biden administration to hand seized Russian funds to Ukraine:

Stop for a second, put yourself in the shoes of any neutral country, and try to think what the second-order consequences of this might be.

Surely diversifying away from sole reliance on the U.S. financial system.

*

The U.S. dollar is buoyed right now by the fact that all countries hold it to conduct international commerce.

If countries begin to use other currencies for international commerce, they don’t need to hold nearly as many dollars, and the value of USD drops.

So called ‘BRICS’ countries (Brazil, Russia, India, China, South Africa) are in talks to create this secondary financial infrastructure right now.

Relations between Saudi Arabia and the U.S. are already fraught.

And China has a significant incentive to undermine the U.S. The above WSJ article again:

‘China increasingly fears Washington’s goal is to isolate it, heightening Beijing’s longstanding concern about access to energy and driving it to take a more active role in the Middle East.’

I see no reason why these countries will not imminently start moving away from the dollar. Put yourself in their shoes. For the simple reason of their own financial diversification, it makes sense.

Can the U.S. dollar hold as the global reserve currency through 2023?

It’s beginning to look less and less likely:

2) U.S. banks don’t have enough money

The news we’re all now familiar with. More precisely put: banks don’t have enough liquid cash. A disproportionate amount of banks’ assets are tied up in long-term Treasuries. These are now underwater, with attempts at accounting tricks to try and maintain the perception of stability.

Sebastian Mallaby on 17 March:

‘Erica Jiang of the University of Southern California and co-authors, presents a scenario in which customers withdraw just half their uninsured deposits. It finds that 186 banks would be forced to realize losses that would render them bankrupt.’

I think it’s politically untenable for the U.S. government to have backstopped depositors who are venture capitalists, and not do the same for farmers/everyday banking depositors of smaller regional banks.

The U.S. government is likely going to get sucked into backstopping more and more depositors. This surely is inflationary.

For a fuller outline of this, see an interview with Balaji here.

3) U.S. Government spending restraint is not coming

There is no political will – Democratic or Republican – to curb entitlement spending in the U.S.

This was Trump (50-second clip) a few weeks ago at CPAC.

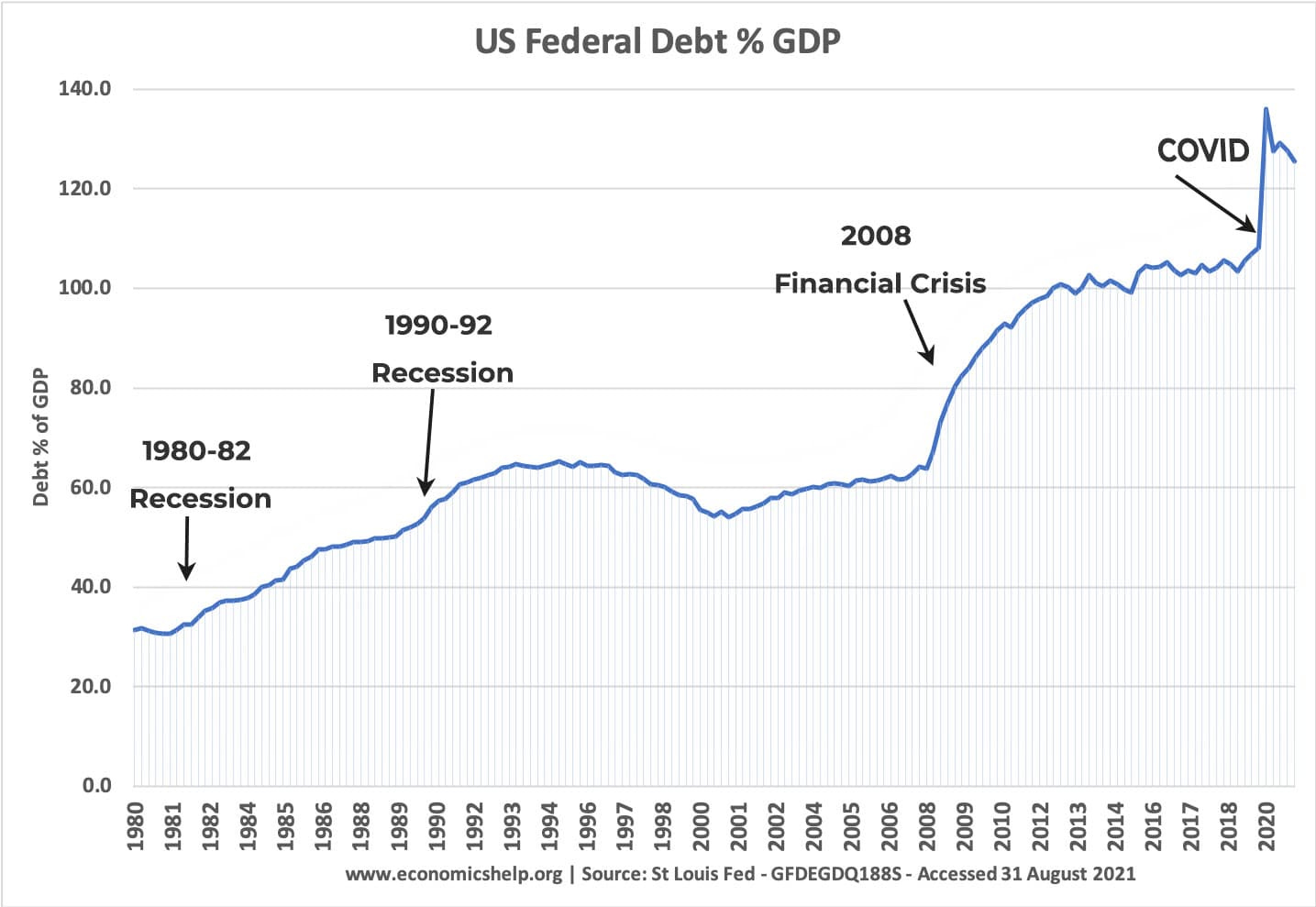

Seeing U.S. government debt pile ever higher (which necessitates money-printing to pay for), why would other central banks and international investors want to keep their money held in USD? (Which would mean other countries continuing to absorb a significant part of U.S. inflation.)

Central banks bought gold at a faster rate last year than they have in any year since 1950. ‘De-dollarisation’ has begun.

‘But, in times of uncertainty…’

The best counter-argument to the totality of this thinking I’ve yet heard is ‘well, in times of financial crisis/uncertainty, people flock to the dollar’.

But, I think Balaji parries this well:

I’m not personally saying ‘implosion is imminent / this will happen’.

I’m nowhere near expert enough to make such a claim. (Though, like many things the past several years, many experts here seem to have things backwards.)

Maybe I’ve spent too much time reading doom-mongers on Twitter…

But the above is my best layperson/interested-amateur attempt to articulate what I think is happening, in as clear language as possible.

Please tell me why I’m wrong.

What to do

I’m not a ‘crypto bro’ who’s running to put all of my savings in Bitcoin. While Bitcoin might form part of a portfolio, I think crypto is still too complicated. It’s not user friendly. And despite the number of people who’ve dabbled with it/made rapid fortunes, I question the number of people who have actually taken pains to get their coins off exchanges to hold locally. (How does the Trezor YouTube channel – one of the leading crypto wallets – have only ~900 views on each of its videos?!)

But I think one can agree with the diagnosis voiced in the crypto world, while coming to one’s own version of a solution.

I very much like this distinction from Arthur Hayes of ‘inside money/outside money’ (60 seconds):

A rapid dollar devaluation now feels plausible enough to me, I would consider having ~30% of one’s net worth ‘out of the system’ (a well-diversified mix of: real estate, physical gold, Bitcoin, art…) prudent.

(I don’t know what rapid dollar devaluation would mean in the UK and for GBP, but I tend to think a not-good scenario for all fiat currencies.)

Recent articles analysing recessions and short-term growth are, I think, missing the point. An uptick in GDP might improve trajectory slightly, but the real issue seems: is the currency fundamentally sound?

None of my three reasons above require consumer panic to lead the dollar to a very precarious position.

Three burrows

Ray Dalio in his latest book quoted an ancient Chinese proverb, ‘A smart rabbit has three burrows’ – meaning, in effect: spread your money across not just three different banks, but countries/geographies.

Having looked into this, there are options like private gold vaulting at Le Freeport, Singapore as a geo-diversified way to park wealth.

Do not settle merely for gold ETFs (inside the system), but get actual physical gold.

This is not tin-foil hat mad. All central banks are doing it: https://www.reuters.com/markets/commodities/central-banks-bought-most-gold-since-1967-last-year-wgc-says-2023-01-31/

To get/vault gold:

- One London-based option: Sharps Pixley

- A U.S.-based one: Scottsdale Mint

- And a list of some other international places

*

Selling something in an investment account; waiting for the funds to ‘settle’; withdrawing them to your main checking account; moving them wherever you’re going to… takes at least a full week in my experience.

I hope I’m wrong and overreacting. But my suggestion, with a part of your net worth, until I start hearing better arguments to the contrary: start now.

Disclaimer: This information should not be considered financial, investment, tax or other professional advice. What you do with your own money is entirely at your own risk.